With the prolonged drought and bushfires affecting many farmers and rural businesses across the country, questions are often raised about accessing existing superannuation to ease their financial stress.

When going through difficult times, it may be frustrating that you aren’t able to access your superannuation account, especially when you need it the most. If you are experiencing severe financial hardship or have a medical disability you just can’t afford, you may have the right to apply to have some of your superannuation released before you retire.

Eligibility for early release of benefits

Superannuation is meant to be a long-term investment to provide benefits in retirement (or death benefits). To qualify for all the tax and associated benefits, a superannuation fund must have this as its “sole purpose”.

Once a person reaches the age of 65 (or dies), access to their superannuation is unrestricted. Prior to that time, one may be able to access the money before retirement if the person meets an alternative “condition of release,” often in dire situations such as a total and permanent disability or terminal illness.

However, the superannuation legislation also recognises that there can be other legitimate situations where the release of monies before the intended time may be appropriate, these include:

- Compassionate grounds – to cover items such as; medical expenses, home modifications to cater for disability, housing loan payments to prevent foreclosure and funeral expenses of dependents

- Severe financial hardship – for amounts up to $10,000 in any year

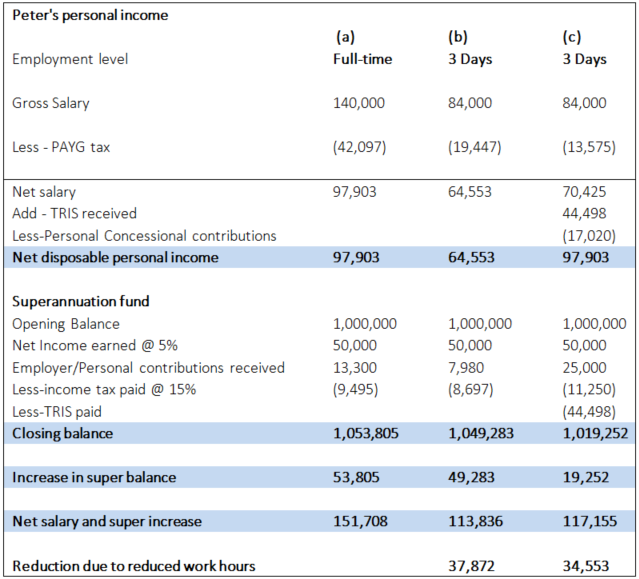

- Transition to retirement – provided the person has reached their “preservation age”

Applying due to severe financial hardship

If you’ve spoken to a financial adviser/counsellor and are confident that early access to superannuation is the right course of action, you can apply for early release based on severe financial hardship. The rules for accessing super on the grounds of financial hardship are quite specific, limited in their application and are often misunderstood.

You are eligible for access under financial hardship if you:

- Are unable to meet reasonable and immediate living expenses such as mortgage payments, rent arrears, medical expenses etc.

- Are receiving an income support payment

- Have been receiving income support payments for at least 26 weeks in a row

A super withdrawal due to severe financial hardship is paid and taxed as a super lump sum. If the condition is met, you will be limited to withdrawing a maximum of $10,000 within a 12-month period.

The eligibility rules are different if you’re over “preservation age” and haven’t retired. You must:

- have reached your preservation age plus 39 weeks

- not be gainfully employed

- have received the income support payments for at least 39 weeks since reaching preservation age

How to apply

Applications for release of superannuation on compassionate grounds must be made to the Australian Taxation Office. Applicants need to provide appropriate documentary evidence to prove the intended use of the funds and demonstrate that the expenses could not be met from alternative sources. Importantly, the relevant expenses must not have already been paid. If approved, the Taxation Office will issue an authority to the fund concerned for a release of the funds.

Applications based on severe financial hardship are made to the trustee of the fund concerned. The general requirement is that the applicant must have been on some form of government support payment for a minimum of 26 weeks and can demonstrate financial hardship. In the case of self- managed superannuation funds, the trust deed of the fund should be checked to ensure that it allows for such payments.